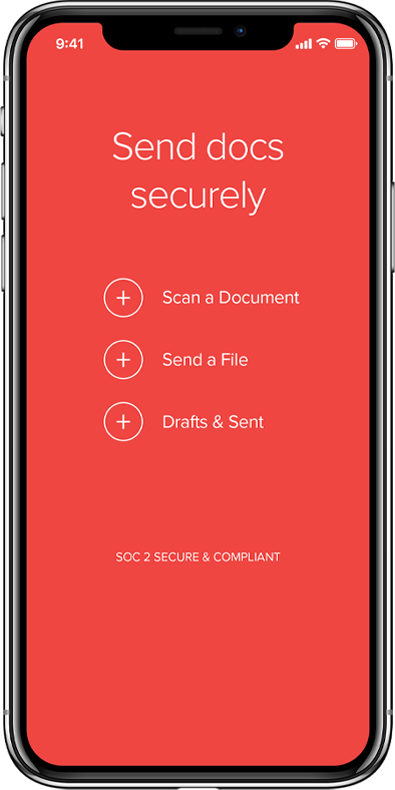

HomeEasy® is designed to keep all members of the loan process connected. The system expedites the exchange of information between borrowers, Realtors, and Loan Originators.

Not your average mortgage app. Explore the difference.

Get updates and information when you need it, wherever you are.

Keep it together. Seriously, this is your one-stop-shop.

Our HomeEasy® app provides a simple, streamlined way to apply for a loan, calculate your mortgage payment, and stay up to date with notifications. Paper documents and face-to-face appointments are a thing of the past. The HomeEasy® app makes getting a mortgage as simple as picking up your phone. Communicate with your Loan Officer, upload documents, and get updated from anywhere. Easy, fast, smart.

And that’s just a few

We just closed on our home and working with Dan was incredible. I knew Dan was a great fit for us, when I asked him a question and he responded with t...

We had the pleasure of working with Dan over the summer while searching for our first home. Dan was always a phone call away and took time from his da...

Dan and his team completely guided me through my entire home buying process. They made sure that I never had any concerns and handled any questions th...

We’re here guide you towards a home loan program that best suits you. We make it simple, you make it home.

Get your HomeEasy® verified pre-approval and begin shopping for homes.

Get Started