What is your debt-to-income ratio?

May 21, 2021

Debt-to-income (DTI) ratio is calculated by dividing your debt by your gross income and is expressed as a percentage. Lenders use your DTI ratio as one metric to determine how much additional debt you can financially afford. Lenders generally view borrowers with a high DTI ratio as an increased risk because of the perceived possibility of default on repayment due to financial hardship.

Mortgage lenders look at two things for a DTI ratio: the front-end ratio and the back-end ratio.

The front-end ratio shows what percentage of your monthly gross income will go toward your housing expenses. Housing expenses include monthly mortgage payments, property taxes, insurance, and HOA dues.

The back-end ratio is the portion of your income needed to cover monthly debts plus your housing expenses. Monthly debt includes credit card bills, car payments, child support, student loans, and any additional debt that shows on your credit report.

Standard front-end limits are typically 28 percent for conventional loans and 29 percent for government-backed loans; standard back-end limits are 36 and 43 percent, respectively.

How to calculate your debt-to-income ratio

To calculate your monthly debt-to-income ratio, complete a few simple steps.

- Add your reoccurring monthly debt that may include:

- Housing costs

- Credit card payments

- Any loan payments (personal or student)

- Alimony or child support

- Car payments

- Divide the total of your monthly debt by your monthly gross income (income before taxes and deductions are taken out). Your gross income can include:

- Wages and salary from a job

- Tips from employment

- Alimony payments received

- Pension payments

- Unemployment earnings

- Multiply the quotient by 100 to express your DTI as a percentage

Example

$2,200 Debt / $7,000 Gross Income = 0.314

0.314 x 100 = 31.4% DTI ratio

It is necessary to consider your entire budget when calculating how much you want to spend on a mortgage. Your lender will not factor in other bills or financial obligations that are not part of the DTI ratio. The mortgage amount you are approved for may be higher than you are comfortable paying when all expenses are considered.

What is an ideal debt-to-income ratio?

When you apply for a mortgage, the lender will examine your finances, including your DTI. Most lenders will look for a debt-to-income ratio that is less than 36 percent. However, some lenders may make exceptions if the percentage is between 36-43 percent for applicants with good credit.

Many lenders will deny any DTI over 43 percent. Because monthly housing expenses and other debts are high compared to your income, it could impact your ability to repay the loan.

Why is your debt-to-income ratio important?

Understanding your DTI is necessary, even if you are not actively applying for a mortgage. Your DTI impacts your financial health and the possibility to qualify for any loan or credit account. Higher DTI percentages will result in higher interest rates when trying to obtain a loan or credit card.

If you realize your DTI is high before applying for a mortgage, you have time to decrease it. Your DTI allows you to see what the trajectory of your finances is based on current behavior. It is a valuable tool when you are making any financial decision.

Does debt-to-income ratio affect your credit score?

Your credit report does not include your income, so your DTI does not affect your credit score. When your credit limits are determined, your income is a factor but is not calculated in your overall credit score. However, your credit score does affect your interest rates and overall ability to qualify for a mortgage.

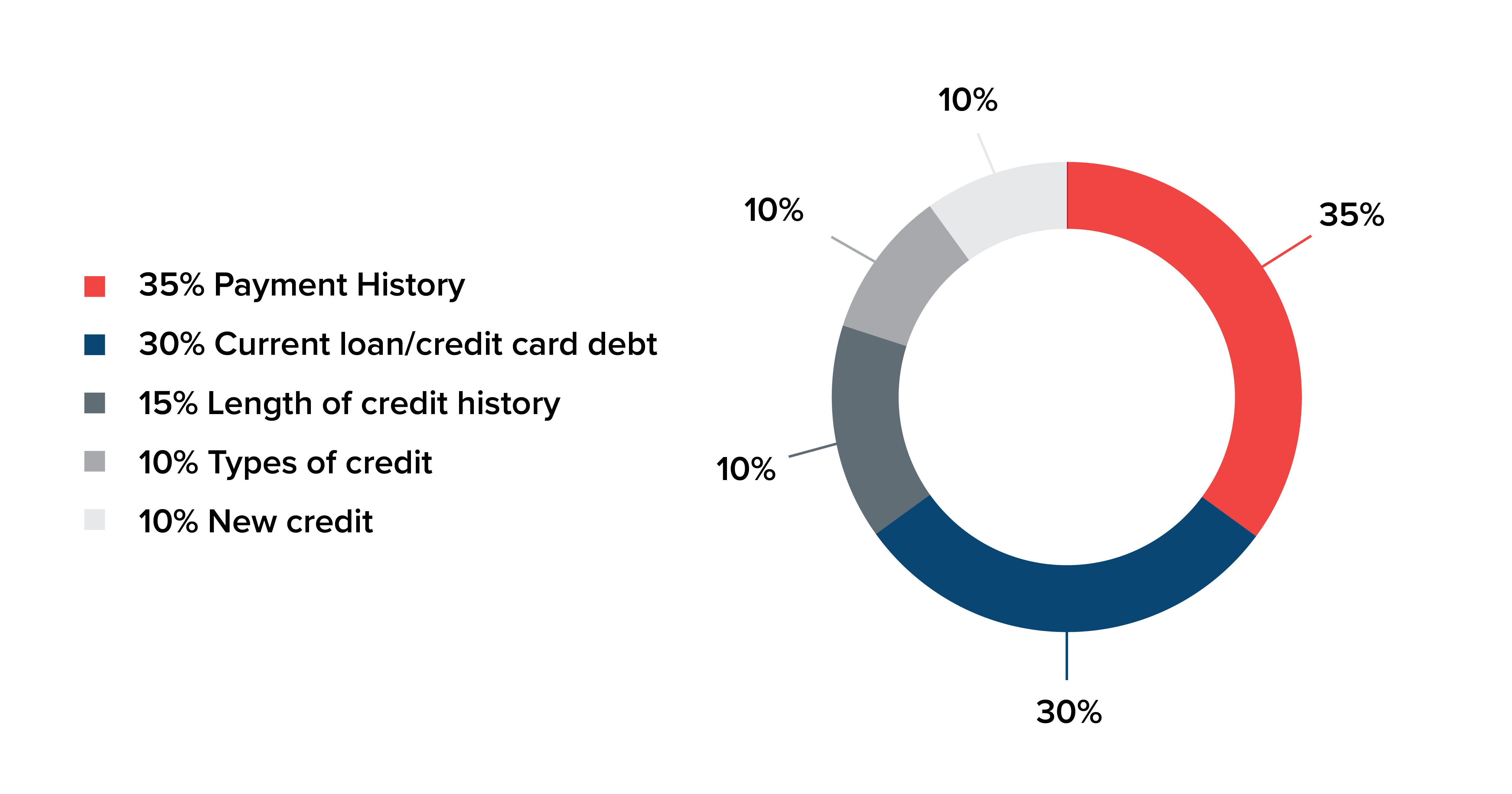

A FICO score is based on five factors:

How much you owe on loans and credit cards is 30 percent of your credit score. This is based on the total amount owed compared to how much credit you have available. Most experts recommend keeping your balances below 30 percent of your credit limit or lower.

How to improve your debt-to-income ratio

The first step to lowering your DTI ratio is to know what it is. Once you calculate your ratio, you can use these tips to improve your DTI and increase your chance of getting a better interest rate when applying for a loan.

- Create a budget and track your spending to reduce or eliminate unnecessary purchases. Be thorough when creating your budget and include all expenses, big or small. Eliminate everything that’s not needed and put that money towards your debt.

- Come up with a plan to pay down your debts. This will look different for everyone based on income, expenses, and debt. It might make more sense to pay off your smallest debt first and continue to eliminate one account at a time (snowball method). Or it might be better to pay off all your debt with the highest interest first (avalanche method). The most important thing is to formulate a plan that works for your personal finances and commit to it.

- Don’t take on any additional debt. Avoid making purchases with your credit cards, and don’t take out new loans. Doing so will increase your DTI ratio and could hurt your credit score. Stay committed to decreasing debt without adding to the problem.

Categories: helpful tips