How your credit score affects your mortgage

July 19, 2021

Everyone knows you’re supposed to have good credit to get a loan. But what is “good” credit, and how much does it impact your loan overall? Although your credit score is not the only financial metric used to determine how your mortgage is structured, it is a significant factor in the process.

What is a good credit score and how does it impact your rates?

Your credit score represents your creditworthiness and shows lenders the risk they will assume if they approve you for a loan. Lenders can quickly estimate your level of future credit risk based on past behavior and determine how likely you are to repay a loan.

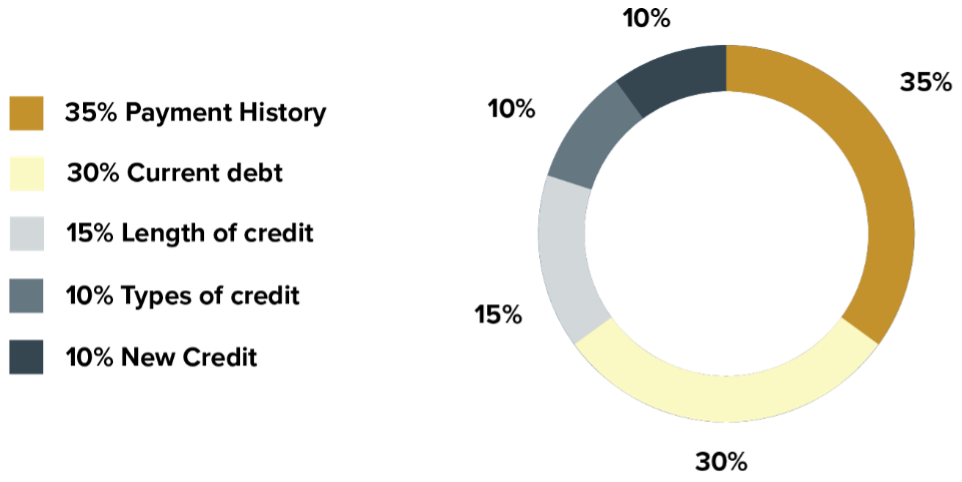

Fair Isaac Corporation (FICO) is a data analytics company that calculates your credit score based on the information in your credit reports. Most lenders use your FICO score when deciding if they should approve you for a loan.

The score is not a fixed number and fluctuates periodically in response to changes in your credit activity. Data is used from these five categories to calculate your FICO score:

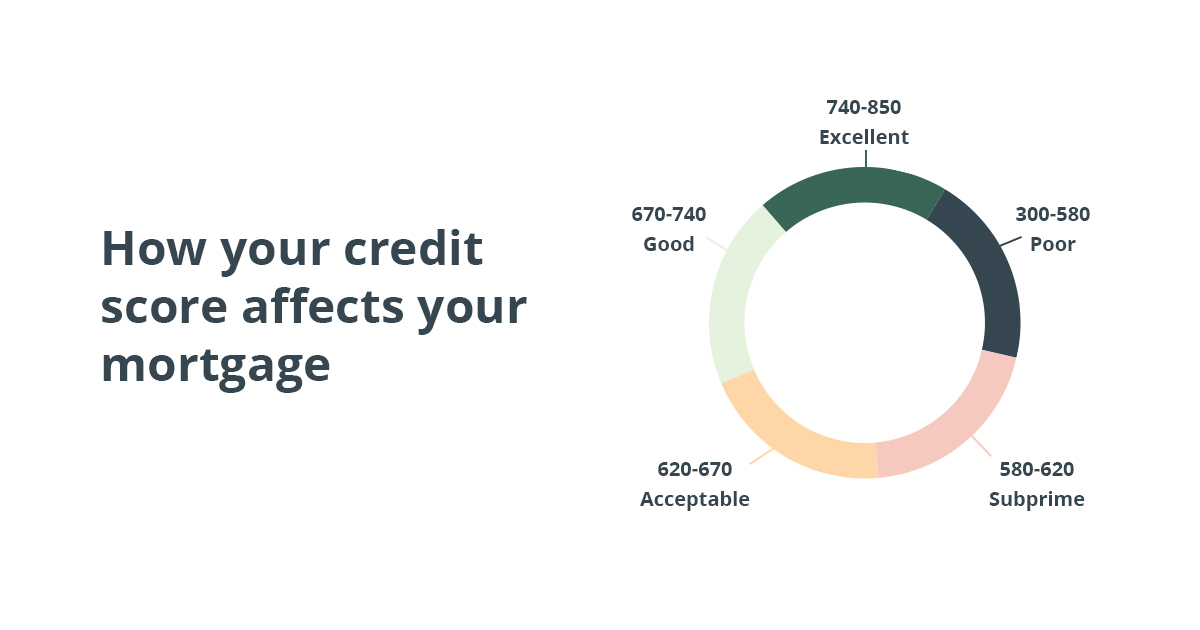

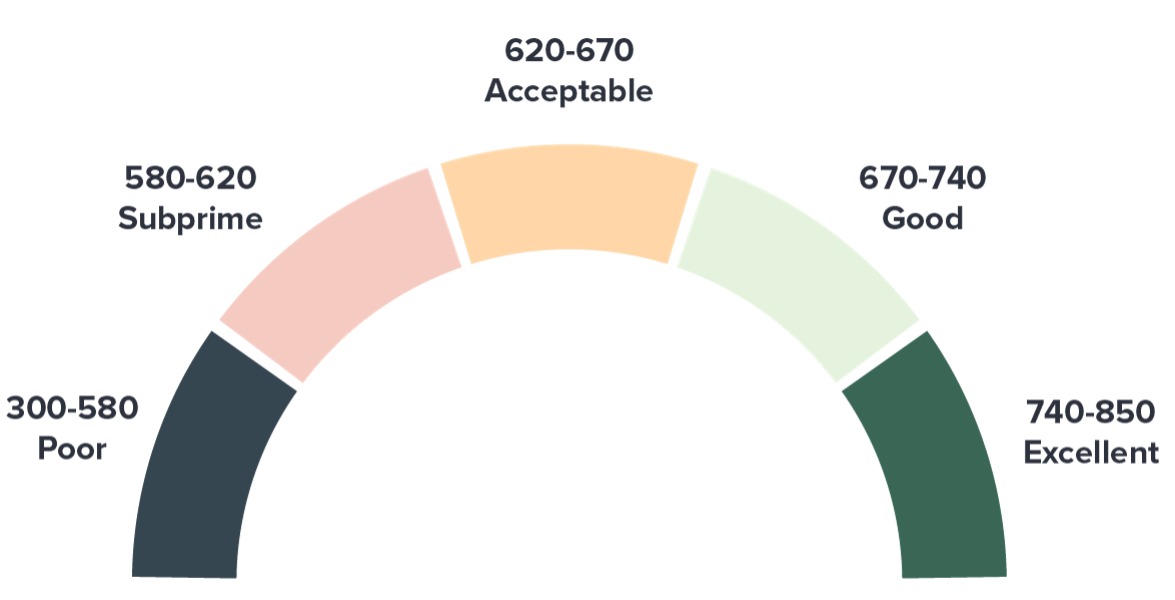

Credit scores range between 300 and 850. Where you fall in this range will determine how much of a risk you are to a lender. When your credit score increases, your risk level decreases. The average FICO credit score in America is 711, and a good credit score is between 670-740.

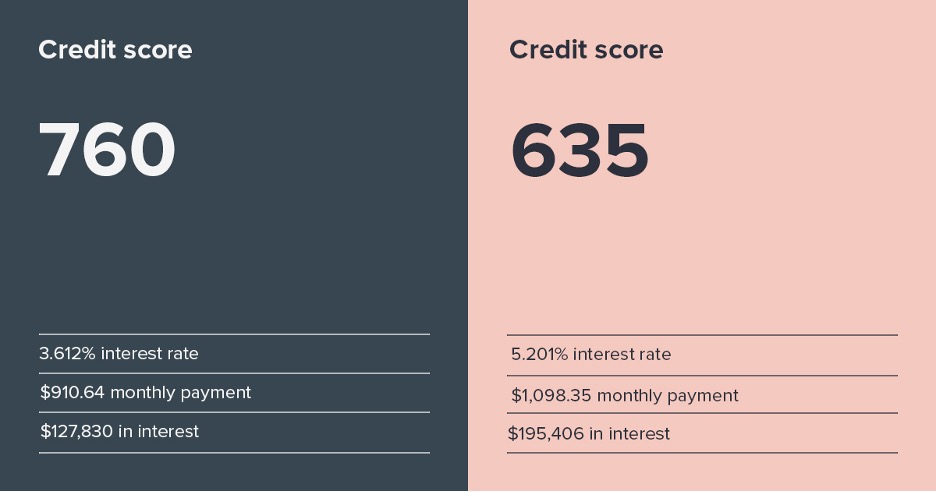

Your credit score directly impacts your mortgage interest rate. You can get approved for a loan with a variation of credit scores and down payment combinations. But the higher your credit score is, the more favorable your interest rate will be.

Lenders rely on credit scores to indicate how likely a borrower is to pay back a loan in full. When lenders are confident a borrower will repay the loan fully and on time, they will charge a lower interest rate.

If you have a lower credit score, you may still be able to get approved for a loan. However, the lender will charge a higher interest rate to guarantee a return on their money.

Let’s use an example for a 30-year-fixed loan for $200,000:

This scenario is for illustrative purposes only.

The difference in your credit score alone could cost $187.71 more per month and $67,576 more over the life of the loan.

Your credit score also affects the cost of your mortgage insurance. If your down payment is less than 20 percent, you are required to have private mortgage insurance (PMI). PMI costs range between 0.5 percent and 1.5 percent of the amount borrowed. If your credit score is low, you will end up paying a higher PMI amount.

Hard and soft credit checks

Soft credit checks are a check on your credit that has no impact on your score. Since a soft check does not change your credit score, you can complete one as frequently as needed.

A hard credit check occurs when a financial institution checks your credit to make a lending decision. A hard check will lower your score by several points and stays on your credit report for up to two years.

At Semper Home Loans, you can receive a pre-approval to see how much money you can borrow and the rates you qualify for by completing a soft credit check.

If you’ve already filled out a formal mortgage application, this does require a hard credit check. However, once a hard check is pulled, you have 45 days to complete multiple credit checks without them impacting your credit score.

How to improve your credit score

There is no wrong time to work towards increasing your credit score. Although some things simply take time to remove from your credit reports, there are plenty of steps you can take to start improving your credit now.

Make payments on time. Payment history is the largest factor in determining your credit score, which is why making timely payments is so critical. Put a system in place to avoid late payments at all costs.

- Create a paper or digital system to keep track of monthly bills

- Set alerts for due dates,

- Automate bill payments from your bank

Don’t max out your accounts. Do not use more than 30% of your available spending limit on your credit cards.

Keep your oldest credit accounts open. Don’t close older credit lines when you pay them off. It may raise your credit utilization ratio and impact your credit score.

Don’t open new accounts. Opening new lines of credit will impact your score for 12-18 months.

Check for errors on your credit report. Request a copy of your credit reports from the three major credit reporting agencies: Experian, Equifax, and TransUnion. You’re entitled to a free credit report from each of the agencies once a year. According to a new investigation by Consumer Reports, 34% of consumers reported finding at least one mistake in their credit reports.

Talk to a loan officer or apply online

If you have questions about your credit score and what rates you qualify for, reach out to a loan officer anytime to discuss what mortgage is right for you. Or you can start your application online today.

Categories: helpful tips