Use this tool to double-check that all the details about your loan are correct on your Closing Disclosure. Lenders are required to provide your Closing Disclosure three business days before your scheduled closing. Use these days wisely—now is the time to resolve problems. If something looks different from what you expected, ask why.

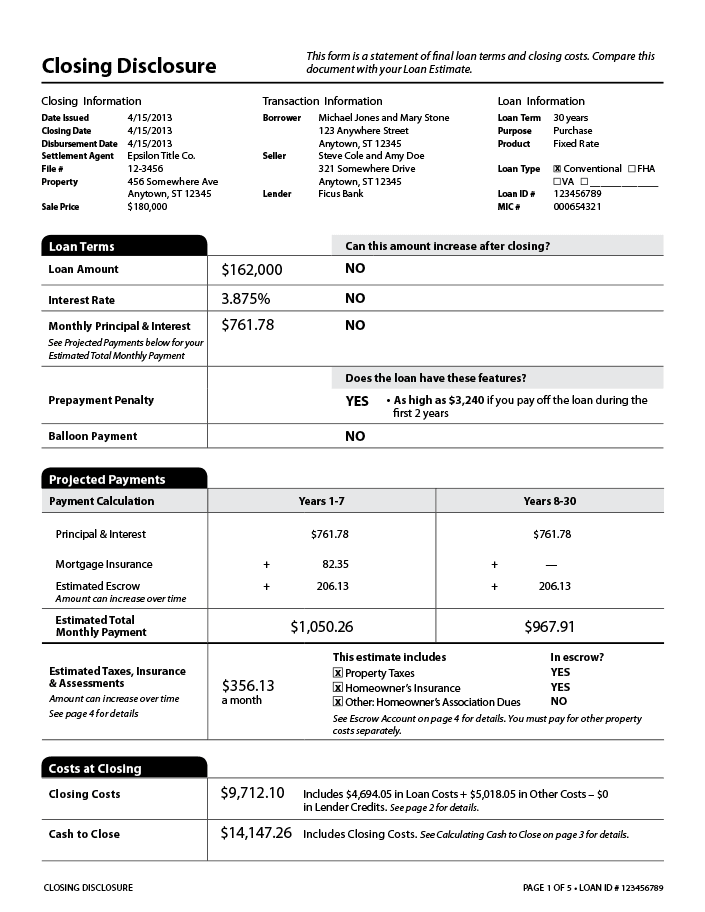

Check the spelling of your name

Check that loan term, purpose, product, and loan type match your most recent Loan Estimate

Check that the loan amount matches your most recent Loan Estimate

Check your interest rate

Monthly Principal & Interest

Does your loan have a prepayment penalty?

Does your loan have a balloon payment?

Prepayment Penalty

Balloon Payment

Principal & Interest

Mortgage Insurance

Estimated Escrow

Estimated Total Monthly Payment

Check that your Estimated Total Monthly Payment matches your most recent Loan Estimate

Check to see if you have items in Estimated Taxes, Insurance & Assessments that are not in escrow

Closing Costs

Cash to Close

Check that your Closing Costs match your most recent Loan Estimate

Check that your Cash to Close matches your most recent Loan Estimate

Check the spelling of your name

Check that loan term, purpose, product, and loan type match your most recent Loan Estimate

Check that the loan amount matches your most recent Loan Estimate

Check your interest rate

Monthly Principal & Interest

Does your loan have a prepayment penalty?

Does your loan have a balloon payment?

Prepayment Penalty

Balloon Payment

Principal & Interest

Mortgage Insurance

Estimated Escrow

Estimated Total Monthly Payment

Check that your Estimated Total Monthly Payment matches your most recent Loan Estimate

Check to see if you have items in Estimated Taxes, Insurance & Assessments that are not in escrow

Closing Costs

Cash to Close

Check that your Closing Costs match your most recent Loan Estimate

Check that your Cash to Close matches your most recent Loan Estimate

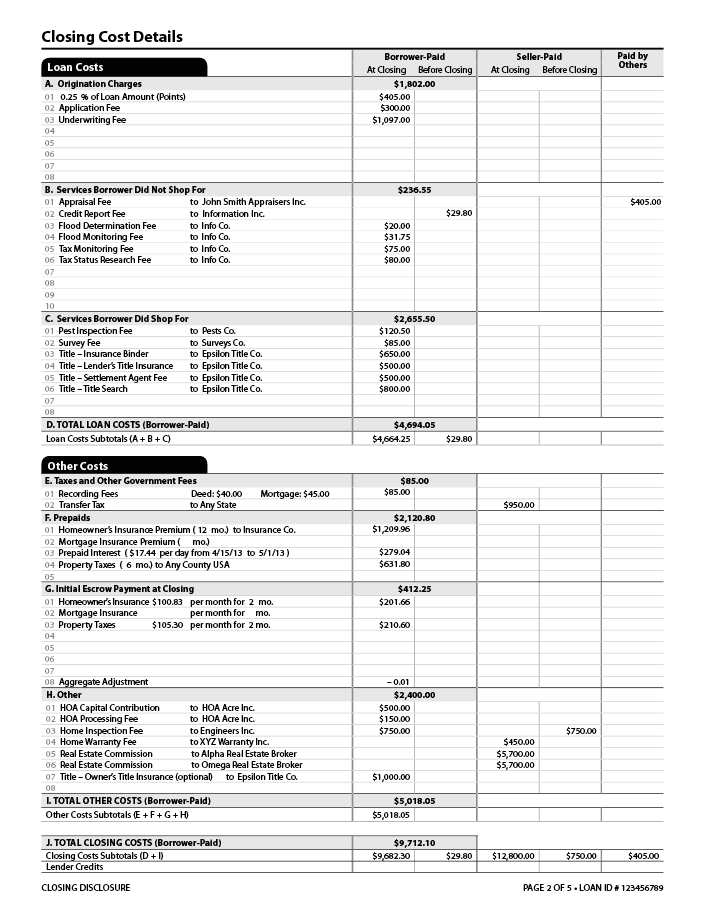

Borrower-Paid

Origination Charges

Points

Check that “Services Borrower Did Not Shop For” are similar to what was shown on your Loan Estimate

Check that prices in “Services Borrower Did Shop For” match what you agreed to pay

Taxes and Other Government Fees

Prepaids

Initial Escrow Payment at Closing

Other Costs

Total Closing Costs

Lender Credits

Borrower-Paid

Origination Charges

Points

Check that “Services Borrower Did Not Shop For” are similar to what was shown on your Loan Estimate

Check that prices in “Services Borrower Did Shop For” match what you agreed to pay

Taxes and Other Government Fees

Prepaids

Initial Escrow Payment at Closing

Other Costs

Total Closing Costs

Lender Credits

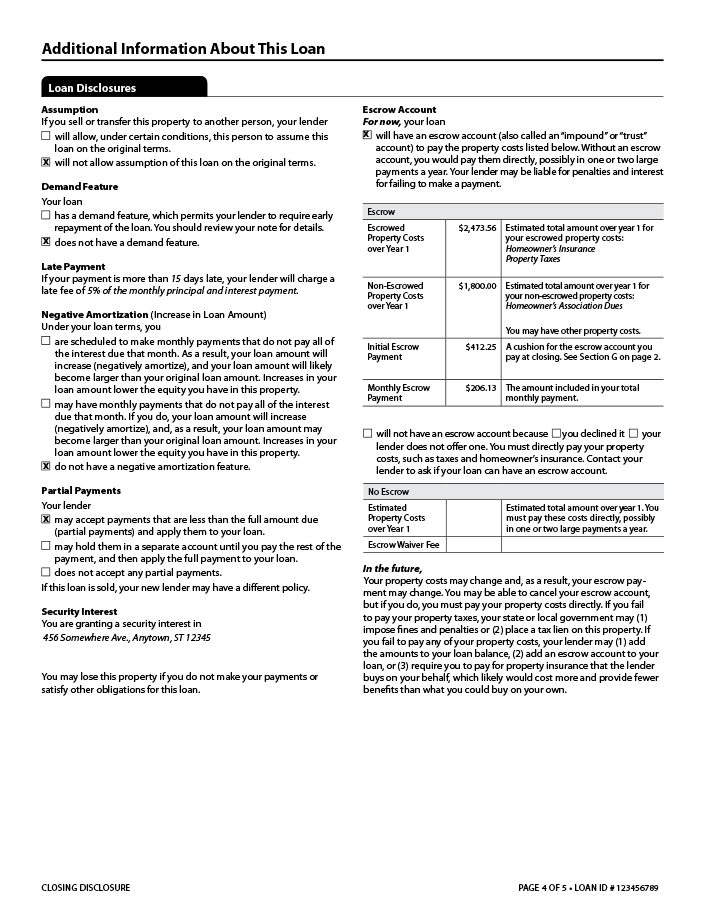

How much will it cost if you make a late payment?

Will your lender accept partial monthly mortgage payments?

Will you have an escrow account?

If you do not have an escrow account, are you paying an escrow waiver fee to the lender?

Assumption

Demand Feature

Negative Amortization

Security Interest

Escrow Account

How much will it cost if you make a late payment?

Will your lender accept partial monthly mortgage payments?

Will you have an escrow account?

If you do not have an escrow account, are you paying an escrow waiver fee to the lender?

Assumption

Demand Feature

Negative Amortization

Security Interest

Escrow Account

Your payoff amount may not be the same as your current balance. Remember that interest in your monthly mortgage payment is paid in arrears. For example, when you make your payment on October 1st, you’re paying the interest that had accrued in the month of September. That means when you apply to refinance on October 1st, your payoff statement will include the unpaid interest for October. Some loan programs such as FHA require an escrow account, while in some other cases when you have 20% equity in a home (your loan is less than 80% of the home value) you may have the option to waive an escrow and pay for things like taxes and homeowners insurance separately. An additional 7 days worth of daily interest is usually included as a buffer and will be returned after the loan has been paid off. Additionally, any other fees that you have incurred but have not paid will be included in the payoff amount.

An escrow account is commonly established when purchasing or refinancing a home. The funds from the account go toward your property taxes, homeowner’s insurance and flood insurance or MI (if applicable). Having an escrow account allows to make just one monthly payment and not worry about paying for things like taxes and insurance out of pocket. When you refinance, a new escrow account will be established with your new loan. Your previous escrow account will close out after your new loan is funded, and any remaining balance that you’ve paid into the account will be sent to you (typically 2-3 weeks after closing).

Closing costs are all fees or charges that are related to originating and closing a mortgage loan. Items such as lender fees, attorney fees, and title fees are considered closing costs. Prepaids are not fees or closing costs. The borrower’s own funds are put into an escrow account and used to pay certain items in advance of when they are due. For example, prepaids can include mortgage insurance and property taxes that are paid prior to closing. They also cover the interest you owe on the loan through the end of the month in which you close.

When you receive your LE (Loan Estimate), keep in mind that the numbers will be estimates and not exact quotes for your final loan payments. If you find any errors on your documents, or any of your personal information is incorrect, please move forward with signing the LE documents and inform your loan officer of the inaccuracies so they can be adjusted for your Closing Disclosure.

An interest rate on a loan only reflects the amount of interest you will be charged as a percentage of your loan amount. APR is a broader measure of the annual cost of the loan to a borrower expressed as a percentage. For example, the APR includes the interest rate as well as most closing costs, discount points, and other fees. While the Federal Reserve is responsible for setting interest rates, the APR is determined by the lender. Your interest rate is calculated based on a number of factors including your credit score, down payment amount, and loan term. The Truth in Lending Act (TILA), requires that both your interest rate and APR be disclosed to you.